Finance Insights in Dynamics 365 for Finance

Organizations are looking forward to reduce risks, by making quick decisions, and free finance personnel from executing repetitive processes and bring their focus on to critical and strategic processes.

The release of this new app shall enable acceleration in the speed of Digital Transformation

How?

With Non-critical tasks automated, with insights to move your business forward, the hinderance of creating or hiring AI expertise is eliminated.

Following are the Business Values those will be available for preview in Wave 1 release 2020:

In this blog, I will cover the ‘Customer Payment Predictions’ business value.

When will we get paid?

Organisations are unable to predict with reliability, when will customer pay.

It leads to:

- Collections processes that start too late,

- Manual and tedious prioritisation of collection processes.

- Orders that are released to customers who may default on their payment.

- Less accurate cash flow forecasts.

Now, suppose, we could predict, when the customer would pay an invoice!

This is exactly what customer payment insights does, predicting when a customer invoice will be paid, thereby helping organisations create collection strategies, thereby improving the probability of being paid on time.

Payment insights help by:

- Proactive collections using payment predictions

- Automated collections and communication strategy formulation.

- Accurate cashflow forecasts by payment predictions.

Using a machine learning model, which leverages historical invoices, payments and customer data, Customer payment insights (Preview) more accurately predicts when a customer will pay an outstanding invoice.

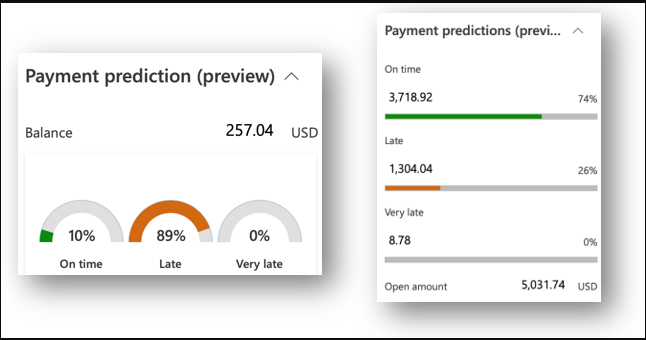

For each open invoice, Customer payment insights (Preview) predicts three payment probabilities:

- Probability of payment being made on time

- Probability of payment being made late

- Probability of payment being made very late

Customer payment insights, provides an aggregated view of expected payments.

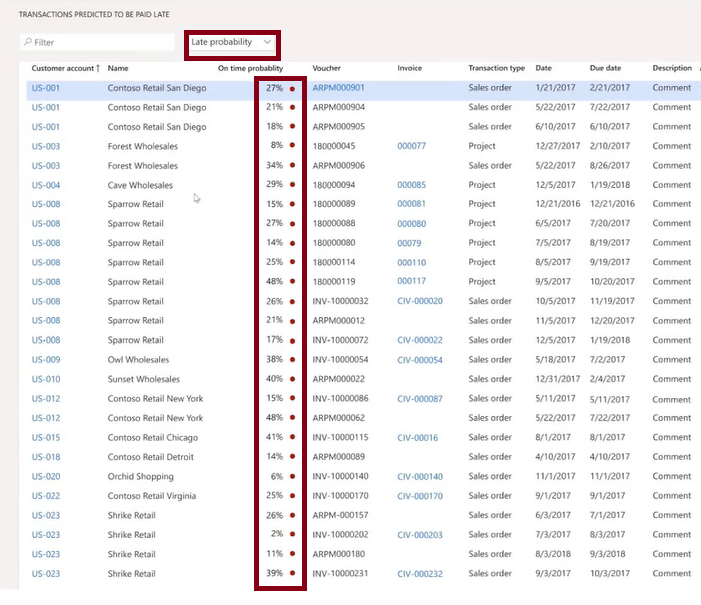

Also, each invoice is assigned a probability of payment on time. If the probability, of payment on time, is less than 50%, the invoices are tagged with a red circle to indicate these invoices require collections attention. You can provide a filter on probability of payments, as we have used “late probability” in the figure below.

Customer Payment Insights also provides information as to how the prediction was arrived at, including:

- Top factors that influenced the predictions,

- The current state of business with the customer, and

- The detailed historical behaviour if the customer w.r.t. payment.

For most businesses, the collections process is a reactive activity; the collections process doesn’t commence until invoices are due.

How to deploy AI solution?

- AI solutions in D365 Finance are built on top of Microsoft AI Builder.

- User can deploy the AI solution, with a single click.

- If an organization isn’t satisfied with the accuracy of predictions, a power user, again using a single click, can enter the AI builder extension experience, and then select or deselect the fields used to generate predictions.

- Once ready, they can train and publish the changes, and the newly trained model will be automatically picked up for predictions in Finance.

Author Name – Lalit Gupta

Comments (2)

Lalit Gupta

Thanks Freddy

Jul 06, 2020 17:18 pmFreddy Carter

Great work, excellent content as usual.

Jun 25, 2020 11:54 am