Increased Employee Productivity

All information is centralised within a single solution, making it easy for employees to access the information they need.

Banks and Financial Services organizations thrive on nurturing long-term relationships with their customers. Customer satisfaction, and the ability to cross-sell and up-sell are vital to these businesses. BAFINS-CX, built on Microsoft Dynamics 365, is tailored to the needs of banks and financial services organizations. It empowers professionals in the financial services sector, across various functions -Sales, Customer Service, and Marketing by providing actionable insights, streamlining processes, and enhancing customer relationships.

Customer 360 | Escalation Matrix | Social Media Connectivity & Sentiment Analysis | Omni-channel integration | Enhanced & Curated Case Management | Recommendations Engine | Churn Analysis | Notifications Management | Dashboards & Reports

Get a comprehensive view of each customer with centralized customer data...

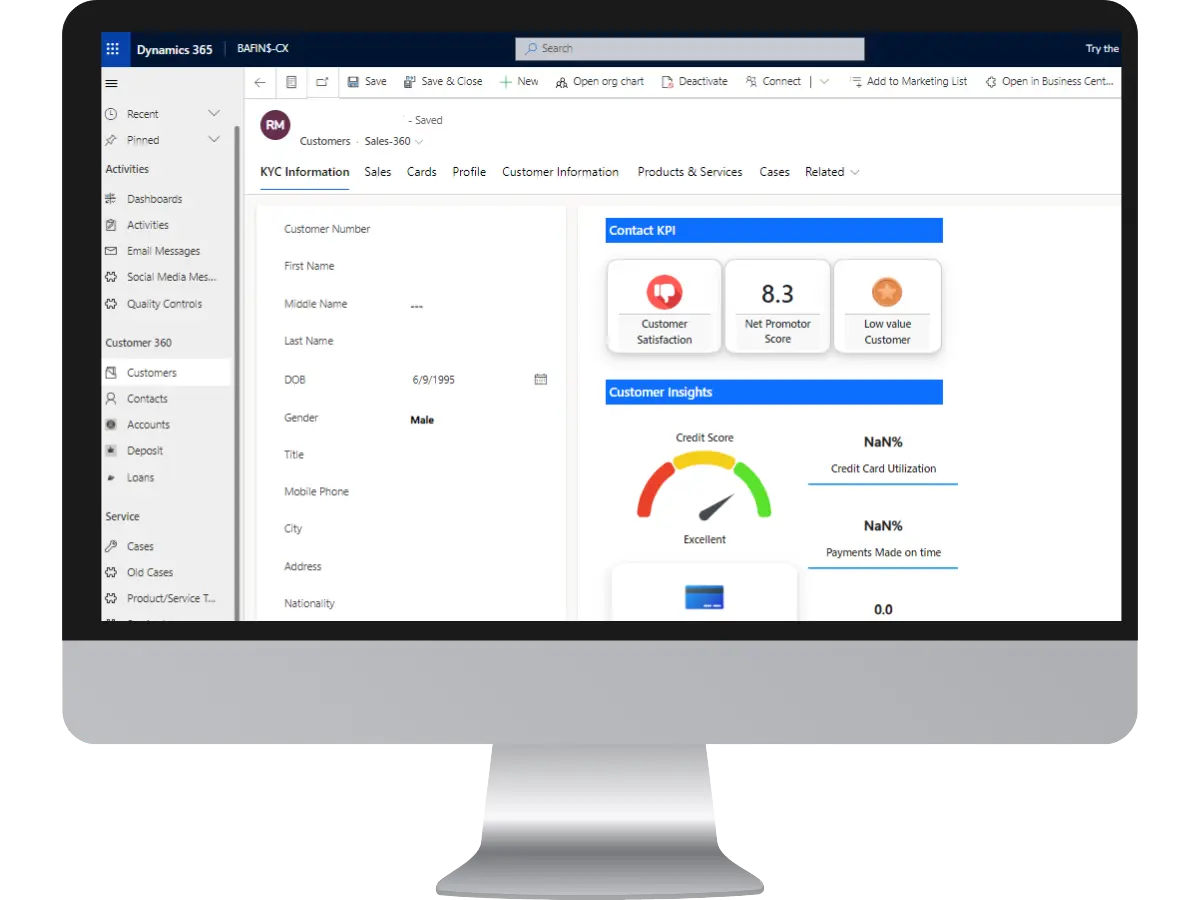

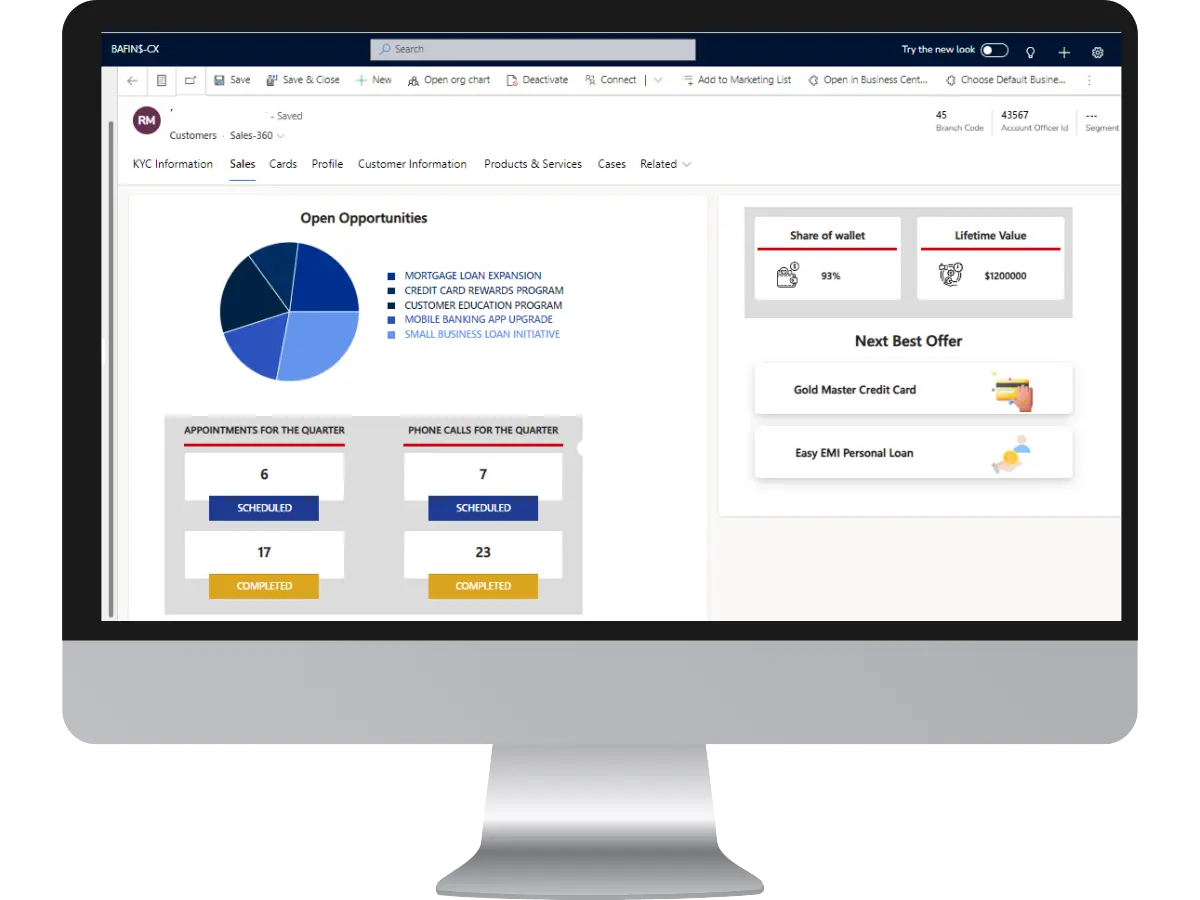

Get a comprehensive view of each customer with centralized customer data, enabling a holistic understanding of their preferences, behaviors, and transaction history. Empower your teams to deliver personalized services, build stronger relationships, and drive customer satisfaction.

Define escalation paths and SLAs to address customer concerns effectively...

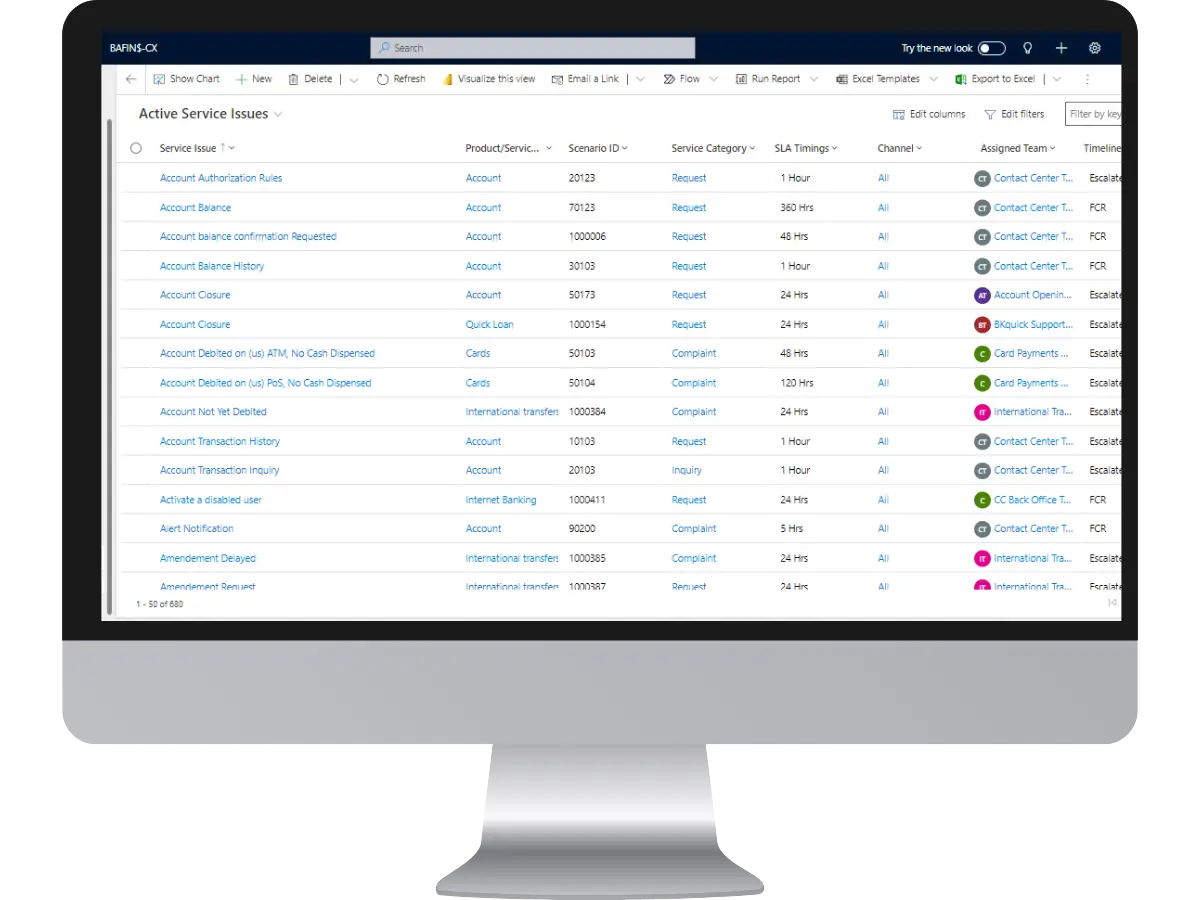

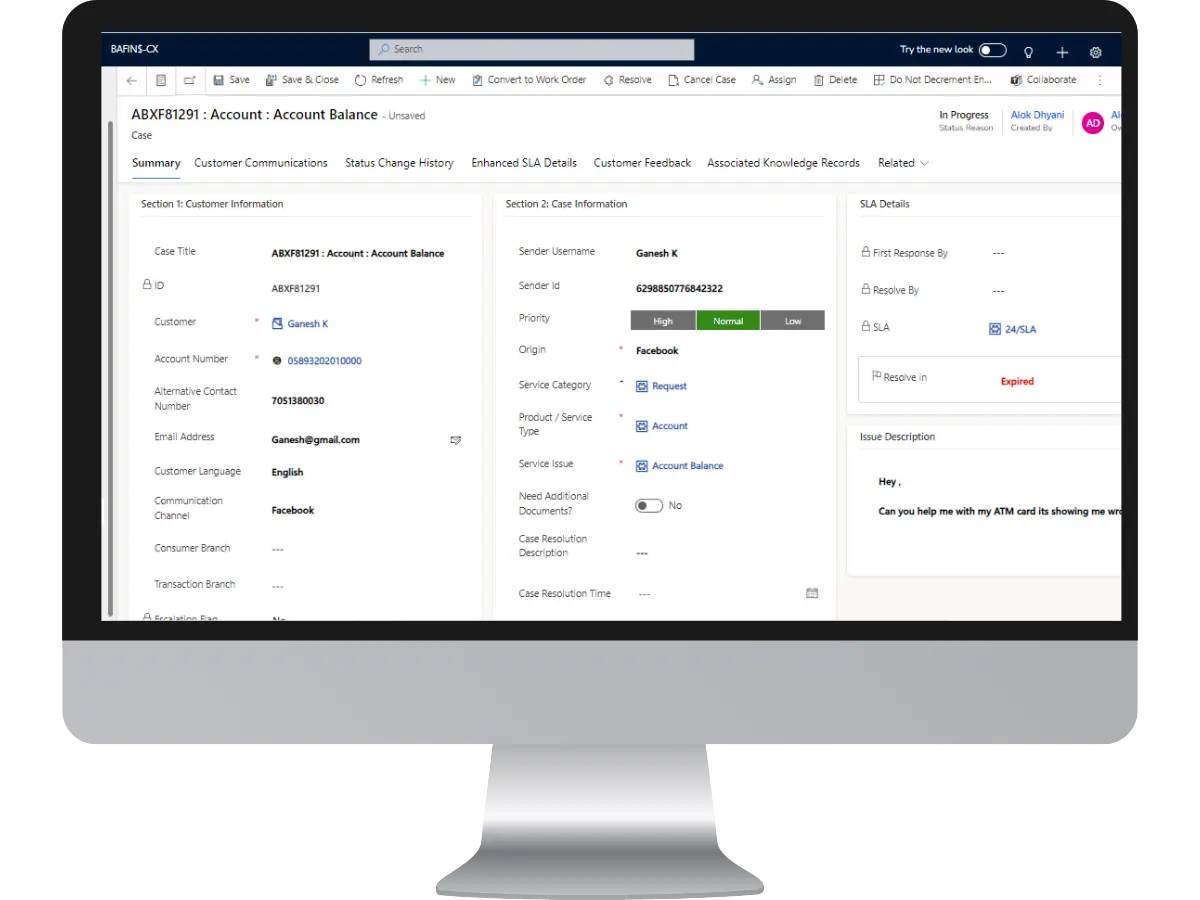

Enable timely and efficient issue resolution. Define escalation paths and SLAs to address customer concerns effectively. Ensure quick identification and resolution of escalated issues, minimizing customer dissatisfaction and reinforcing trust. Keep customers informed and engaged with timely notifications. Configure and automate notifications for critical updates, offers, or personalized messages.

Stay connected with your audience through various social media channels...

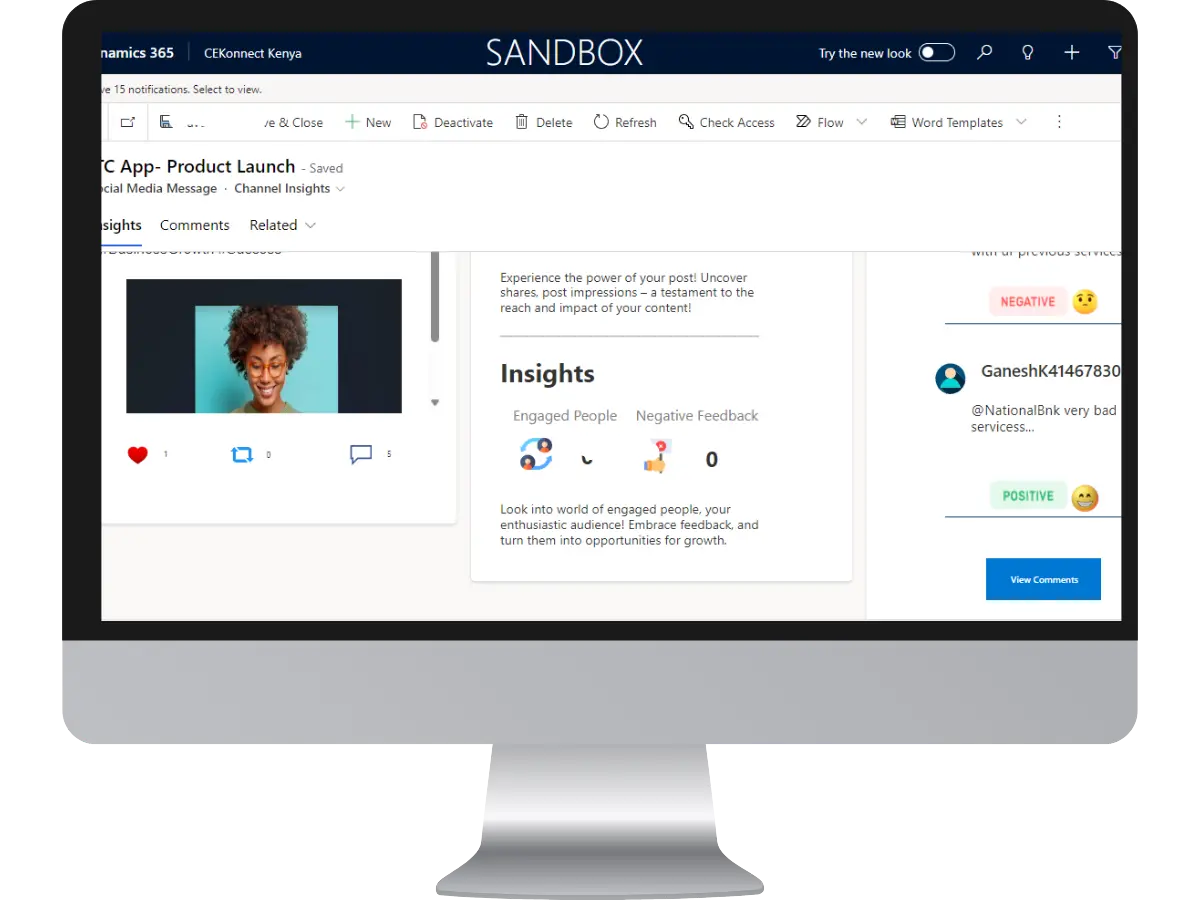

Stay connected with your audience through various social media channels, including Facebook, Instagram, and X. Leverage sentiment analysis to analyze the tone, context, and emotions conveyed in customer communications. The system categorizes sentiments as positive, negative, or neutral, enabling proactive responses and tailored services.

Deliver a seamless and consistent experience across all channels...

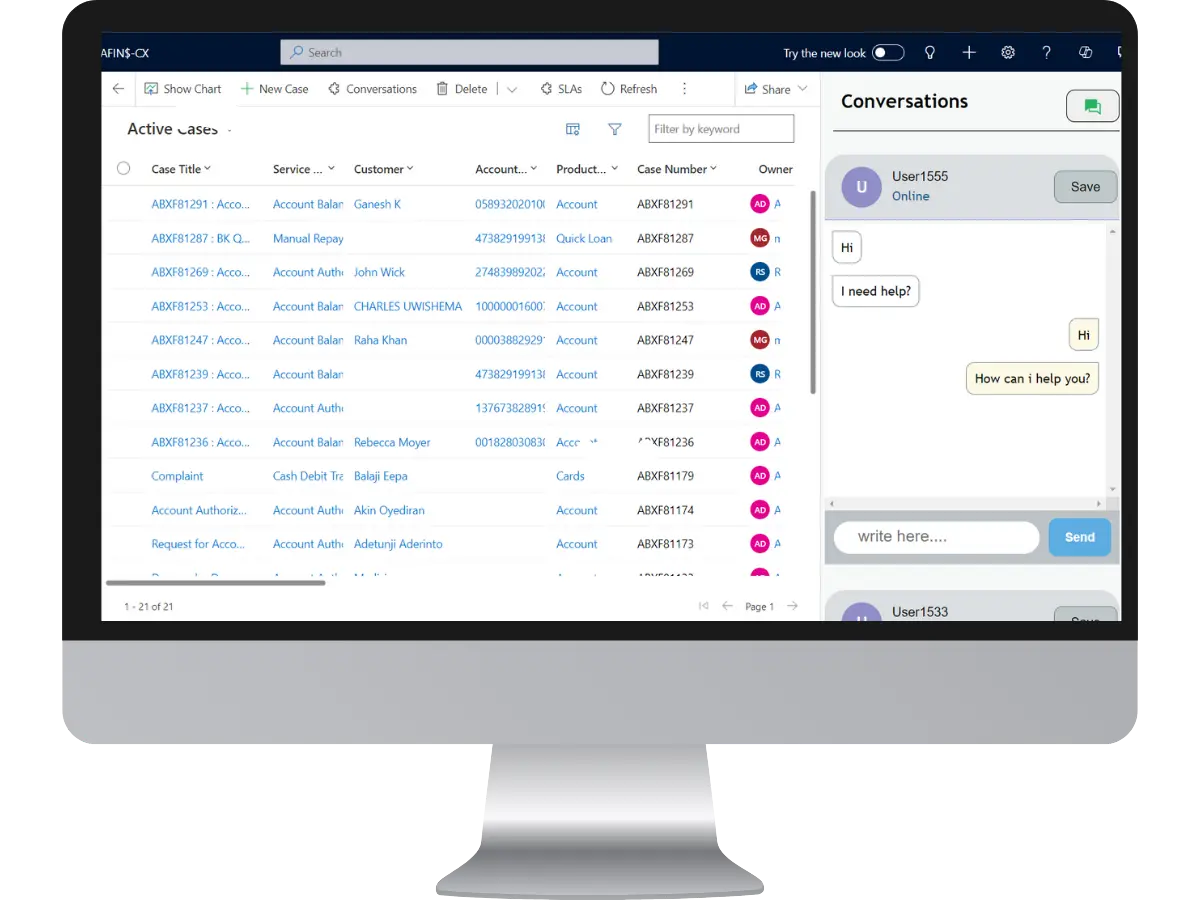

Deliver a seamless and consistent experience across all channels. Whether it's Social Media, WhatsApp, IVR, or SMS interactions, this feature ensures that customers receive a unified experience, fostering loyalty and satisfaction. Enhance real-time customer support through live chat features, fostering immediate and personalized interactions.

Streamline case creation, assignment, and resolution...

Streamline case creation, assignment, and resolution. This feature enhances efficiency, reduces response times, and ensures that each case is handled effectively.

Leverage intelligent recommendations and provide personalized...

Leverage intelligent recommendations and provide personalized product or service suggestions based on customer behavior, preferences, and historical data. Tap cross-selling and up-selling opportunities to maximize revenue and customer engagement.

All information is centralised within a single solution, making it easy for employees to access the information they need.

Gain a complete view of customers with centralized data, enabling personalized service, stronger relationships, and enhanced satisfaction.

D365 for Financial Organisations automates repetitive tasks and workflows, reducing manual effort and increasing operational efficiency.

Our solutions are built to spec, ensuring that regardless of complexity, our system precisely supports your organisation in the way you need.

Leverage advanced reporting and insights to help identify new business opportunities and potential revenue streams.

Highly personalised marketing campaigns and advanced customer service capabilities increase customer satisfaction and loyalty.

Expect to see higher CSAT with call outcomes by improving agents' access to internal collaboration tools

Improved agent productivity results in a decrease in average agent handling time

Integration with various social media platforms enables customers to reach out through their preferred channel

View all the transactions and activities performed by any customer, including all the cases (requests/complaints) create

Enable collaboration by integrating BAFINS-CX with your existing systems

Industry Expertise: With over two decades of experience in delivering digital transformation solutions, Alletec is a trusted partner for financial services organizations. Our expertise in Microsoft Business Applications, including Dynamics 365, Power Platform, Azure, and other applications from the Microsoft stack, enables us to provide our IP driven solutions, as well as tailored solutions that meet the unique needs of the financial services industry.

Consulting Services: Expert guidance to help you navigate your digital transformation journey.

Implementation Services: Seamless deployment of Dynamics 365 solutions and BAFINS-CX, tailored to your business requirements.

Support & Maintenance: Ongoing support to ensure your systems run smoothly and efficiently.

Customization & Integration: Tailored solutions that integrate seamlessly with your existing systems and processes.

Transform your business with Dynamics 365 Business Central. Contact Alletec to explore how this cutting-edge solution can empower your business for sustained growth and success.

BAFINS-CX's Customer 360 feature consolidates customer data into a unified profile, encompassing preferences, behaviors, and transaction histories. This comprehensive view enables financial institutions to tailor services and offerings, thereby enhancing customer satisfaction and fostering stronger relationships.

The Escalation Matrix in BAFFINS-CX allows institutions to define clear escalation paths and service level agreements (SLAs). This structured approach ensures timely and effective resolution of customer concerns, minimizing dissatisfaction and reinforcing trust in the institution's responsiveness.

By integrating with platforms like Facebook, Instagram, and X, BAFINS-CX enables institutions to monitor and engage with customer sentiments in real time. This connectivity allows for proactive responses to feedback, enhancing brand reputation and customer loyalty.

Yes, BAFINS-CX's Omni-channel Integration ensures seamless customer interactions across multiple platforms, including email, chat, and social media. This unified approach provides a consistent and efficient customer experience, regardless of the communication channel.

The Recommendations Engine leverages customer data to suggest relevant products or services, facilitating effective cross-selling and up-selling strategies. This targeted approach not only increases revenue opportunities but also enhances customer satisfaction by addressing specific needs.