Dynamics 365 for Financial Services Organizations

Strengthening customer engagements, operations and repeat business

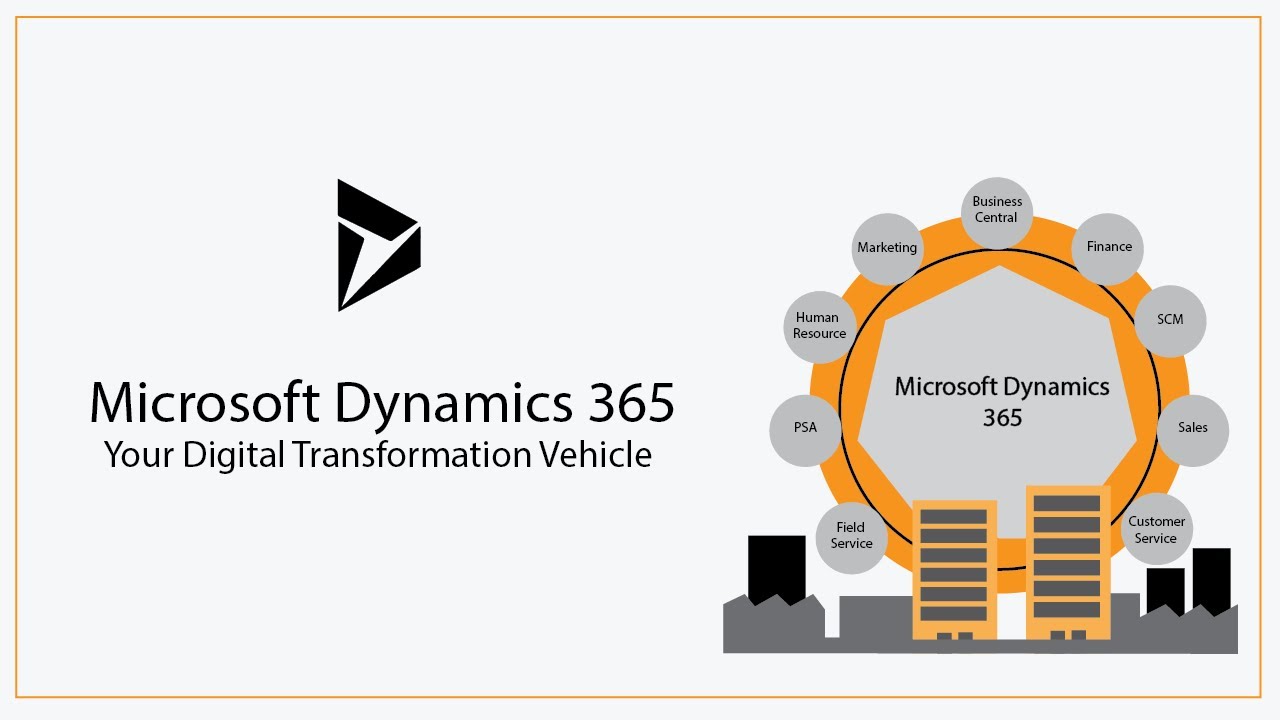

Empowering Financial Services with Digital Transformation

Technology is a key enabler and differentiator for organizations in the financial services business. These organizations have a basket of offerings, and striving to take a bigger share of customer wallet is critical for lowering cost of sales, increasing revenue, and profitability. This makes customer all functions of customer engagement - sales, customer service, and marketing - super important. Analysing customer preferences and behaviour pattern from data are increasingly becoming key to delivering personalized offers and services.

Banks

Banks provide a variety of services to their customers, including savings and checking accounts, loans, mortgages, and credit cards...

Banks

Banks provide a variety of services to their customers, including savings and checking accounts, loans, mortgages, and credit cards. In addition they also provide a rich set of services to their corporate customers. Banks need high customer satisfaction, and customer proximity, to upsell and cross sell.

Insurance companies

Insurance companies, be they Life Insurance companies or General Insurance companies, need to know their customers very well, and also exhibit...

Insurance companies

Insurance companies, be they Life Insurance companies or General Insurance companies, need to know their customers very well, and also exhibit tremendous operational efficiency in case of a claim process, to ensure high customer satisfaction.

Financial Advisory firms

Financial advisory firms offer personalized financial planning, investment management, and other financial services to high-net-worth individuals...

Financial Advisory firms

Financial advisory firms offer personalized financial planning, investment management, and other financial services to high-net-worth individuals. They may also be advising on budgeting, saving, investing, and retirement planning. They must know their customer profiles, preferences, constraints, and history extremely well to succeed.

Mortgage Companies

Mortgage business has both lenders and brokers who worked together to further the business. While brokers act as intermediaries between borrowers...

Mortgage Companies

Mortgage business has both lenders and brokers who worked together to further the business. While brokers act as intermediaries between borrowers and mortgage lenders, helping clients find suitable mortgage products, the lenders provide loans specifically for purchasing real estate. Large banks may have separate departments performing these functions. These functions require speed, efficiency, and winning customer trust through personalization of services.

Microfinance institutions

Micro finance institutions offer financial services to individuals and small businesses that lack access to traditional banking services. Usually, they have a large...

Microfinance institutions

Micro finance institutions offer financial services to individuals and small businesses that lack access to traditional banking services. Usually, they have a large addressable market, though the deal sizes are small. Minimizing the cost of sales, per deal, and getting large volumes is therefore very important for business success.

Fintech companies

Fintech companies use technology to provide financial services, such as online lending platforms, digital wallets, and blockchain-based solutions...

Fintech companies

Fintech companies use technology to provide financial services, such as online lending platforms, digital wallets, and blockchain-based solutions. Usage of right technology becomes vital to know customers well.

BAFINS-CX: The customer engagement solution built on Microsoft Dynamics 365

Enhanced customer engagement, optimized operations, improved compliance

Unified Customer Profile

Access a comprehensive view of customer data from multiple sources. Get a view of each customer with centralized customer data...

Unified Customer Profile

Access a comprehensive view of customer data from multiple sources. Get a comprehensive view of each customer with centralized customer data, enabling a holistic understanding of their preferences, behaviours, and transaction history. Empower your teams to deliver personalized services, build stronger relationships, and drive customer satisfaction.

Omnichannel Engagement

Connect with customers across various channels – email, phone, social media, and in-person – to provide consistent and seamless experiences. Deliver a seamless...

Omnichannel Engagement

Connect with customers across various channels – email, phone, social media, and in- person – to provide consistent and seamless experiences. Deliver a seamless and consistent experience across Social Media, WhatsApp, IVR, or SMS interactions. This ensures that customers receive a unified experience, fostering loyalty and satisfaction.

Social Media Connectivity & Sentiment Analysis

Stay connected with your customers and prospects through various social media channels,including Facebook, Instagram, and X. Leverage sentiment analysis...

Social Media Connectivity & Sentiment Analysis

Stay connected with your customers and prospects through various social media channels, including Facebook, Instagram, and X. Leverage sentiment analysis to analyze the tone, context, and emotions conveyed in customer communications. The system categorizes sentiments as positive, negative, or neutral, enabling proactive responses and tailored services.

Escalation matrix

Enable timely and efficient issue resolution. Define escalation paths and SLAs to address customer concerns effectively. Ensure quick identification and resolution...

Escalation matrix

Enable timely and efficient issue resolution. Define escalation paths and SLAs to address customer concerns effectively. Ensure quick identification and resolution of escalated issues, minimizing customer dissatisfaction and reinforcing trust.

AI-driven Insights

Utilize AI and machine learning to gain actionable insights into customer behavior, preferences, and trends...

AI-driven Insights

AI-driven Insights Utilize AI and machine learning to gain actionable insights into customer behavior, preferences, and trends.

Live agent chat

Enhance real-time customer support through live chat features, fostering immediate and personalized interactions...

Live agent chat

Enhance real-time customer support through live chat features, fostering immediate and personalized interactions.

Solutions for SMB & Enterprises

Elevating Possibilities:Explore Our Resources

Why Alletec

Alletec is a trusted Microsoft

Business Applications partner.

20 years of experience and

a global presence.

Industry Expertise: With over two decades of experience in delivering digital transformation solutions, Alletec is a trusted partner for financial services organizations. Our expertise in Microsoft Business Applications, including Dynamics 365, Power Platform, Azure, and other applications from the Microsoft stack, enables us to provide our IP driven solutions, as well as tailored solutions that meet the unique needs of the financial services industry.

Consulting Services: Expert guidance to help you navigate your digital transformation journey.

Implementation Services: Seamless deployment of Dynamics 365 solutions and BAFINS-CX, tailored to your business requirements.

Support & Maintenance: Ongoing support to ensure your systems run smoothly and efficiently.

Customization & Integration: Tailored solutions that integrate seamlessly with your existing systems and processes.

Get Started Today

Transform your business with Dynamics 365 Business Central. Contact Alletec to explore how this cutting-edge solution can empower your business for sustained growth and success.

Frequently Asked Questions

Microsoft Dynamics 365 offers Financial Services firms a comprehensive platform for managing client relationships, automating financial operations, and ensuring regulatory compliance. With integrated tools for customer engagement, financial reporting, and risk management, firms can improve operational efficiency, enhance client satisfaction, and drive business growth.

Dynamics 365 offers essential features for Financial Services, including CRM for client management, advanced analytics for financial forecasting, automated workflows for compliance and risk management, and integrated financial reporting tools. These features enable firms to streamline operations, optimize decision-making, and deliver personalized client experiences.

Dynamics 365 helps Financial Services firms ensure regulatory compliance by automating compliance workflows, providing real-time data tracking, and offering audit-ready financial reports. The platform’s advanced security features also help safeguard sensitive client information, while built-in compliance tools help firms meet industry standards and reduce risk.

Yes, Dynamics 365 can be customized to meet the unique needs of various Financial Services sectors such as banking, insurance, wealth management, and capital markets. Alletec specializes in tailoring Dynamics 365 to align with sector-specific requirements, ensuring that your firm can manage clients, transactions, and compliance with industry precision.

Dynamics 365 enhances customer engagement by providing a 360-degree view of client interactions, enabling personalized service, and improving communication across multiple channels. The platform integrates CRM with financial data, allowing firms to offer tailored advice, anticipate client needs, and improve client retention through better service.

Financial Services firms can expect a strong ROI from Dynamics 365 by improving operational efficiency, reducing manual errors, and enhancing compliance management. The platform’s real-time analytics, automated workflows, and enhanced client management tools lead to better decision-making, cost savings, and overall business growth